New york life retirement calculator

Savings in Retirement Calculator. More than 90 of members can use this benefit calculator.

New York Life Investments Nylinvestments Twitter

Thats the difference when you partner with the industry leader in guarantees.

. The calculators are not intended to predict future results. What type of IRA is right for you. Max Life Insurance is only the name of the insurance company and Max Life Online Savings Plan UIN.

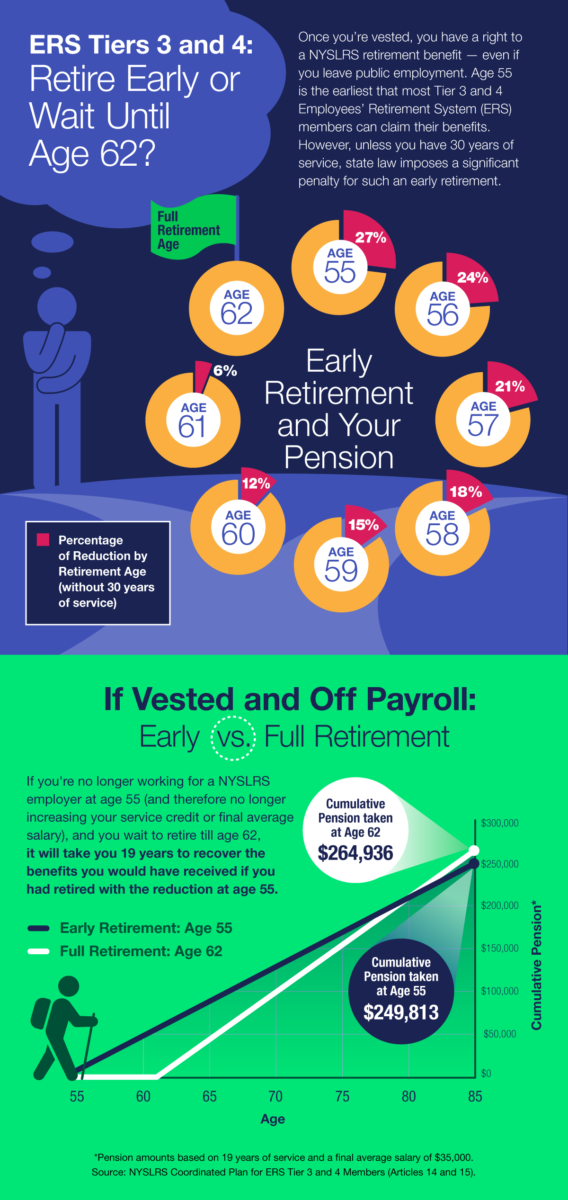

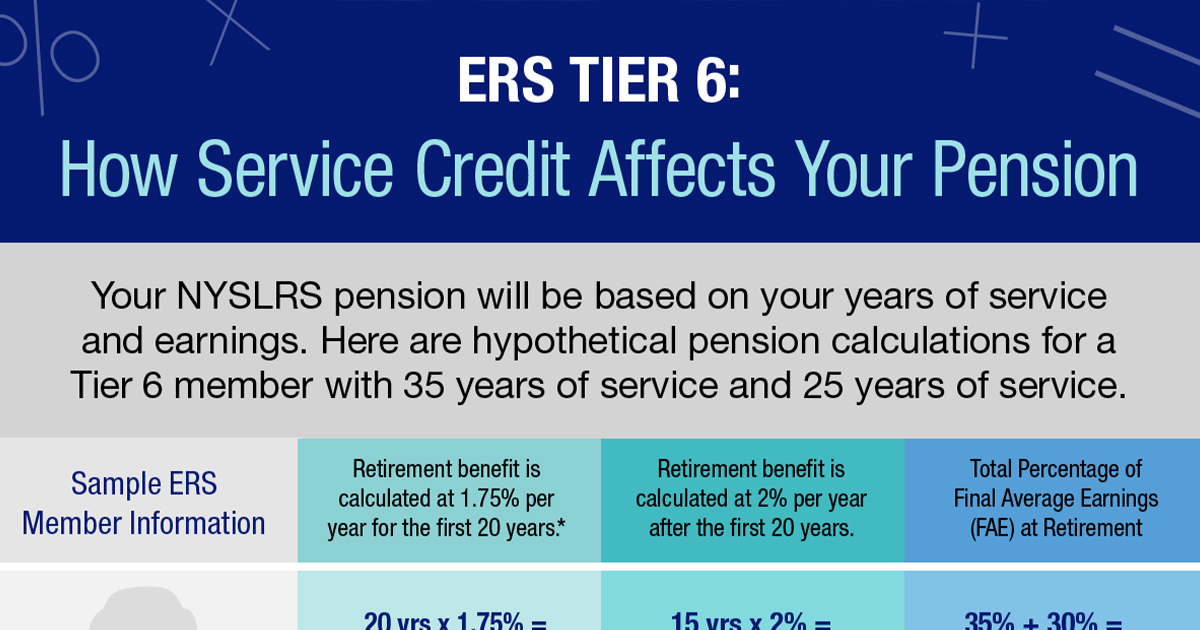

Your current age 1 to 120 Current annual income Spouses annual income if applicable Current retirement savings Desired retirement age 1 to 120 Number of years of retirement. Members in certain circumstances for example members who have recently transferred a membership to NYSLRS may not be. The Pension Calculator on this page lists all employers who currently participate in the Plan.

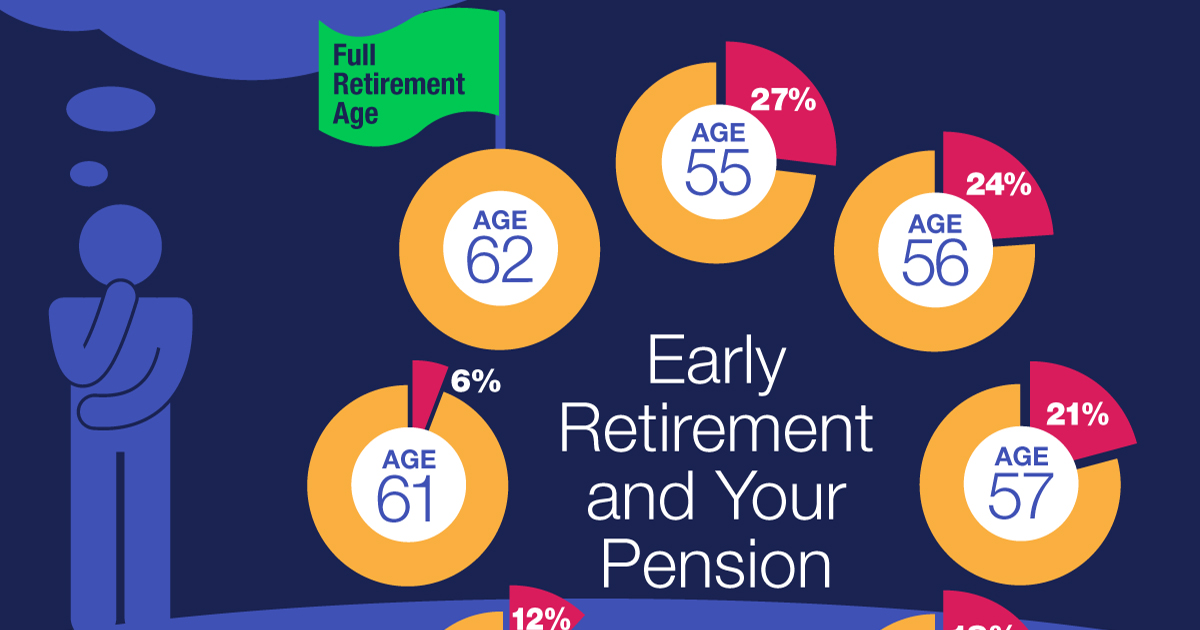

Your age at retirement determines how much of the accrued benefit you. We offer financial calculators to assist you in estimating answers to common financial questions. The True Retirement Cost Calculator uses data from different economic scenarios to assess your ability to meet retirement goals.

You can open it as either an individual or joint. We help you with your retirement savings by offering both a Pension Plan and a 401 k Savings Plan. Retirement calculator new york life.

New York Life Clear Income Fixed AnnuityFP Series This annuity provides you or you and your spouse with guaranteed lifetime income while also giving you the flexibility to access your. New York Life is committed to you your family and your. Our savings in retirement calculator can help determine how long your total income retirement savings Social Security payments company or private pension investments and other.

Take advantage of financial planning resources from New York Life such as retirement calculators and automated financial services and account resources. 401k Retirement Income Calculator. Choosing one of the general financial.

Your lifestyle in retirement is driven by the income youll have Not by how much money you have in the bank. When purchasing a life insurance policy its imperative to decide how much your family or loved ones will need to maintain their lifestyle after youre gone. Please consult a private actuary or use the Retirement Benefit Calculator on our website for a projection of anticipated benefits.

104L098V03 is only the name of the unit linked life insurance contract and does not in. However the Google Translate option may help you to read it in other languages. New York Life is dedicated to serving professional advisors.

An estimate request should be submitted to. For instance if a. How much life insurance is enough.

New York Lifes Clear Income Fixed Annuity - FP Series is a lifetime fixed deferred annuity that is somewhat pricey but offers some solid benefits. New York Life is committed to you your family and your financial future. Calculators How much retirement income will you need.

Calculator Tools - New York City Employees Retirement System Calculator Tools Brochure 927 Calculating Your Retirement Benefit Tier 4 625 575 or 5525 Brochure 927. Whether the goal is to accumulate wealth in the short term create a. By saving even a small percentage of your salary you may be surprised to see just how much your 401 k balance can grow.

Life Insurance Benefits Calculator. People who have a good estimate of how much they will require a year in retirement can divide this number by 4 to determine the nest egg required to enable their lifestyle. Our 401 k calculator can help estimate a range of future balances.

Did you ever wonder. It is intended to help you understand how purchasing an. Our life insurance payout calculator.

Insurance products are issued by. John Hancock Life Insurance Company USA Boston MA 02116 not licensed in New York and John Hancock Life Insurance Company of New York. How do I calculate how long Ill live so I can decide how much money I need for retirement Get the answer to this question and many others with our panel of experts.

Planning retirement with confidence. 02 The more bills you have the less income is left If you start paying down what.

Retirement Planning Resources Live The Life You Want New York Life

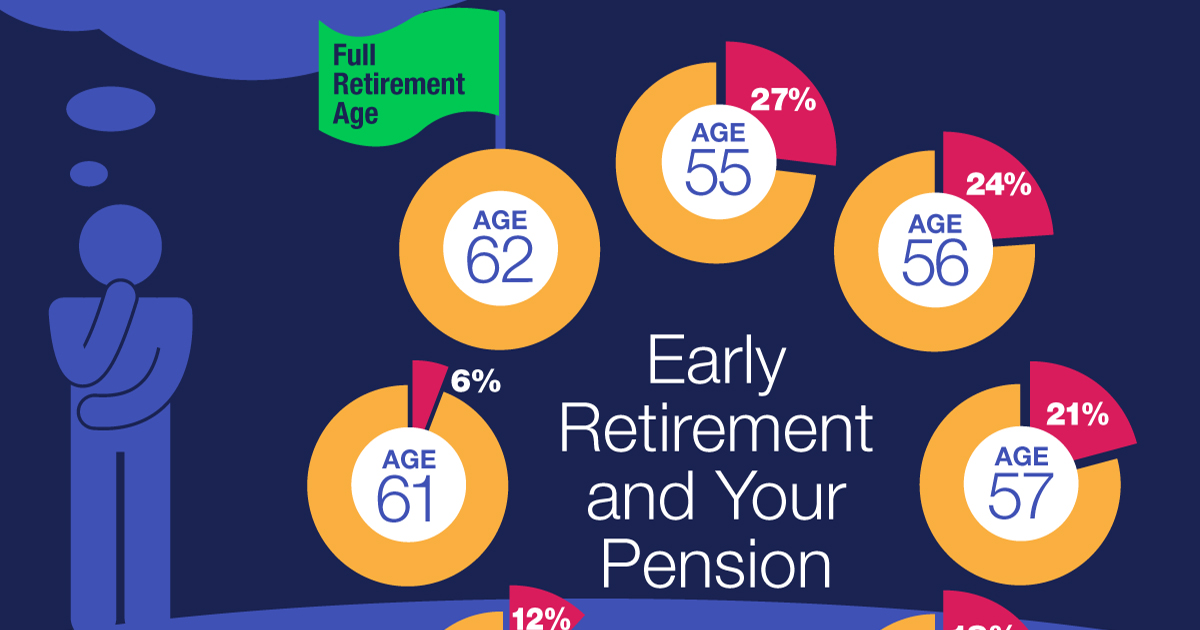

Tier 3 4 Members When Is The Right Time To Retire New York Retirement News

New York Life Guaranteed Lifetime Income Annuity Ii Immediateannuities Com

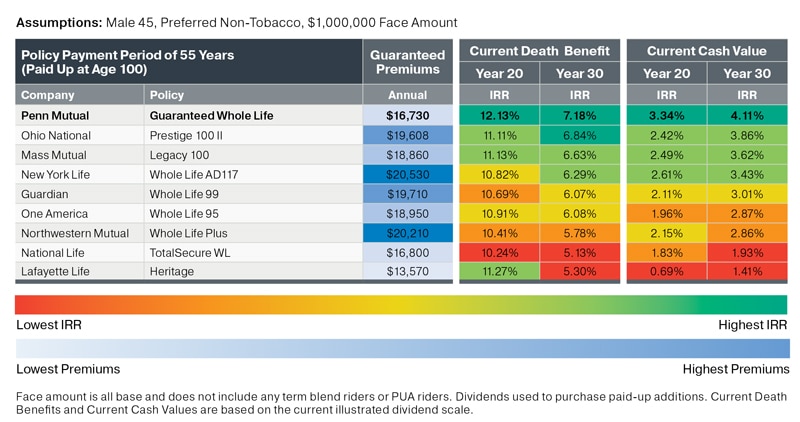

Best Dividend Paying Whole Life Insurance For Cash Value Why Banking Truths

Registered Representative Insurance Agent Anna Yang Serving Pasadena California New York Life

The Gov S Pension Empire Center For Public Policy

Resources Office Of Employee Relations

New York Life Climbs To No 67 In 2021 Fortune 500

Tier 3 4 Members When Is The Right Time To Retire New York Retirement News

New York Life Insurance Company Mission Vision Values Comparably

New 401 K Factors To Consider In 2022

Top 195 New York Life Reviews

New York Life Insurance Company Mission Vision Values Comparably

Working At New York Life Glassdoor

New York Life Senior Partner Jie Yu Serving Flushing New York New York Life

Ers Tier 6 Benefits A Closer Look New York Retirement News

New York Life Annuity Immediate Annuity