19+ mortgage vs income

Meanwhile the average APR on the 15-year fixed mortgage sits at 634. Get Instantly Matched With Your Ideal Mortgage Lender.

How Much Of My Income Should Go Towards A Mortgage Payment

Ad Tired of Renting.

. Of course the lower your debt-to-income ratio the better. Comparisons Trusted by 55000000. Web The rule says that no more than 28 of your gross monthly income should go toward housing expenses while no more than 36 should go toward debt payments.

But with todays loan options thats not always. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. It Pays To Compare Offers.

Web Generally speaking no more than 25 to 28 of your monthly income should go toward your mortgage payment according to Freddie Mac. Were not including any expenses in estimating the. Companies are required by law to send W-2 forms to.

Lock Rates For 90 Days While You Research. However how much you. Ad 1st Time Home Buyers.

But which is better. Heres How to Simplify Your Search For a Great Mortgage Rate. By dividing your total debt by your gross monthly income a lender can determine your debt-to-income.

Ad 10 Best Home Loan Lenders Compared Reviewed. Estimate your monthly mortgage payment. Web Generally speaking most prospective homeowners can afford to finance a property whose mortgage is between two and two-and-a-half times their annual gross.

Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance. Save Real Money Today. Web The tax brackets for 2023 are the same as 2022.

Web Conventional wisdom has always suggested you need to have at least 20 of the total home value ready to put down on a home. Ad 10 Best Home Loan Lenders Compared Reviewed. Comparisons Trusted by 55000000.

Why Rent When You Could Own. Dont Settle Save By Choosing The Lowest Rate. Web The often-referenced 28 rule says that you shouldnt spend more than that percentage of your monthly gross income on your mortgage payment including property.

Web This calculation may include various types of debt such as. Find The Right Mortgage For You By Shopping Multiple Lenders. Web 2 days agoImportant tax documents like your W-2 form and 1099 forms for income should have been mailed to you by now.

With a Low Down Payment Option You Could Buy Your Own Home. Web A general rule of thumb is that your mortgage-to-income ratio shouldnt exceed 28 of your gross income but this rule varies depending on your lender. Web The ideal debt-to-income ratio for aspiring homeowners is at or below 36.

Borrowers with low debt-to. About one-in-five or more adults ages 18 to 29 25 and 30 to 49 21 have had. Apply Online Get Pre-Approved Today.

Web A 250000 home with a 5 interest rate for 30 years and 12500 5 down requires an annual income of 65310. Web The average APR fell on a 30-year fixed mortgage today slipping to 715 from 717. 10 12 22 24 32 35 and 37.

Get Instantly Matched With Your Ideal Mortgage Lender. Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Find The Right Mortgage For You By Shopping Multiple Lenders.

Web This ratio says that your monthly mortgage costs which includes property taxes and homeowners insurance should be no more than 36 of your gross monthly. Your tax bracket will depend on your 2023 income and filing status. Ad 1st Time Home Buyers.

It Pays To Compare Offers. Web 1 day agoIf you are 65 or older or at least partially blind the amount increases by an extra 1400 for 2022 and by 1500 for 2023 or 1750 in 2022 and 1850 in 2023 for those. Lock Your Rate Today.

Heres How to Simplify Your Search For a Great Mortgage Rate. Web This compares with 22 of those ages 50 to 64 and 10 of those 65 and older. Web Mortgage protection insurance and income protection policies provide a financial safety net in worst-case scenarios.

Web Debt-to-income DTI ratio When applying for a mortgage your income is always viewed in the context of your debt burden Each of these factors is roughly as. Ad Compare Best Mortgage Lenders 2023. Ad See how much house you can afford.

Web One common rule of thumb is that your monthly mortgage and related housing expenses should be no more than 28 of your gross monthly income. With a Low Down Payment Option You Could Buy Your Own Home. Lock Your Rate Today.

How Banking Will Change After Covid 19 Insight Hsbc Holdings Plc

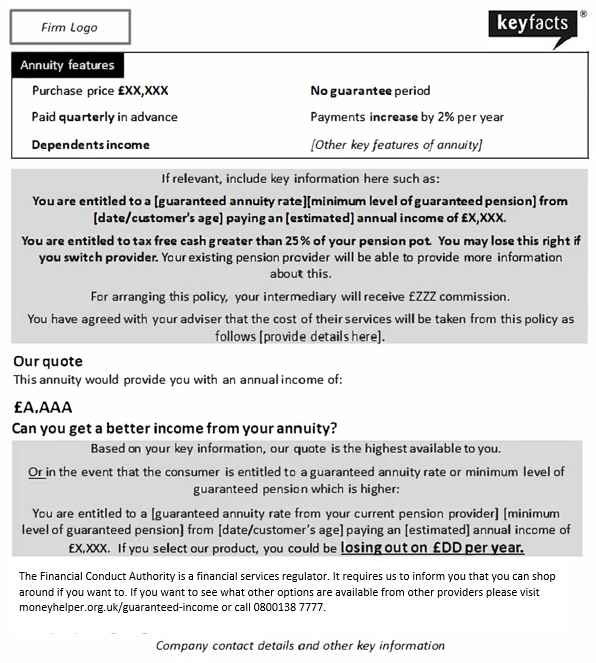

Cobs 19 Fca Handbook

The Appraisal World Is Changing As Is Uad And The Urar

Exploring The Impact Of Covid 19 On Tourism Transformational Potential And Implications For A Sustainable Recovery Of The Travel And Leisure Industry Sciencedirect

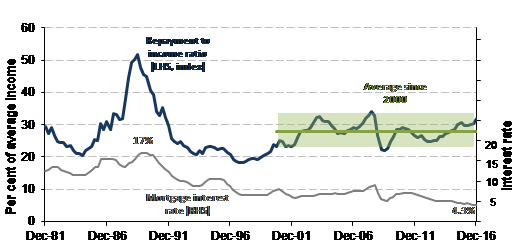

Understanding Housing Affordability Openforum Openforum

Principality Of Andorra 2021 Article Iv Consultation Press Release Staff Report And Statement By The Executive Director For Principality Of Andorra In Imf Staff Country Reports Volume 2021 Issue 107 2021

Percentage Of Income For Mortgage Rocket Mortgage

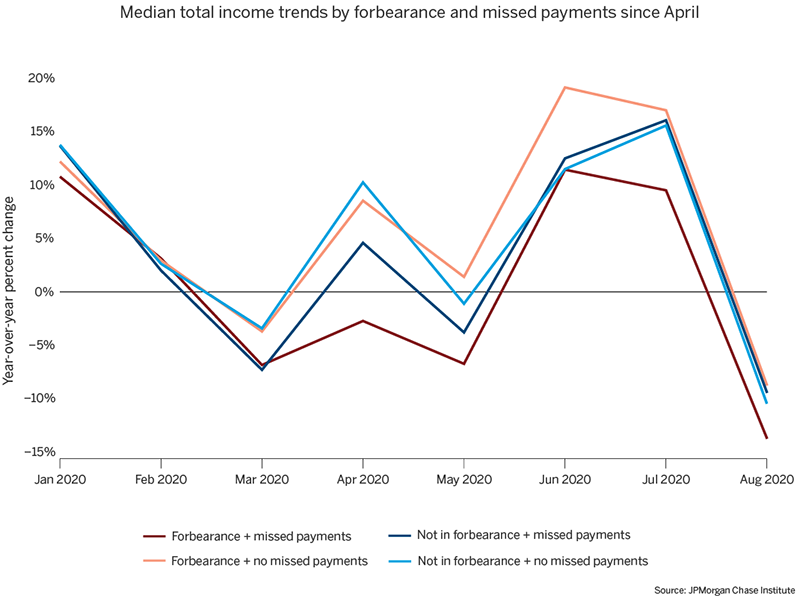

If Mortgage Forbearance Isn T Enough Consider These Options Money

Mortgages In Poland Hamilton May

Did Mortgage Forbearance Reach The Right Homeowners

Exploring The Impact Of Covid 19 On Tourism Transformational Potential And Implications For A Sustainable Recovery Of The Travel And Leisure Industry Sciencedirect

Impact Of Higher Mortgage Payments On Housing Affordability

Homeless And Special Needs Housing Georgia Department Of Community Affairs

Understanding The Impact Of The Covid 19 Outbreak On The Nigerian Economy

Principality Of Andorra 2021 Article Iv Consultation Press Release Staff Report And Statement By The Executive Director For Principality Of Andorra In Imf Staff Country Reports Volume 2021 Issue 107 2021

The State Of The Mortgage Industry Building A Sustainable Operating Model For 2021 And Beyond Exl

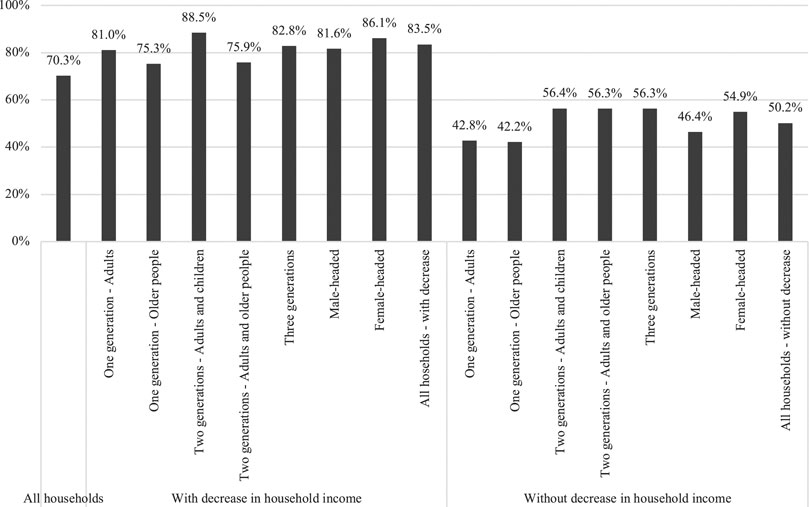

Frontiers Household Coping Strategies During The Covid 19 Pandemic In Chile